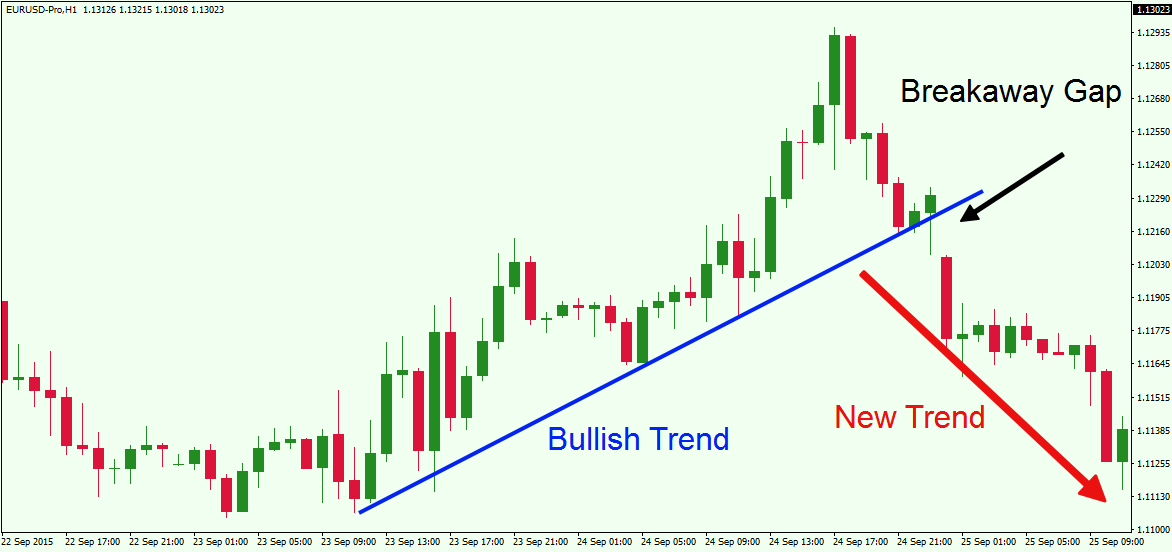

In Forex, gaps usually occur on Monday, at the beginning of a trading session. If a trend is bearish and a bearish gap is formed, it's bearish continuation gap.

Table of contents

- Silver Price Analysis: XAG/USD drosp below $26.00 on rising wedge confirmation

- Patrones de Candelas Japonesas

- Upside-Downside Gap Three Methods Technical Patterns | Myfxbook

- Análisis Técnico – USDJPY aún sin mostrar signos de rellenar el gap bajista

Gold has been able to take advantage of this and recover. France, Italy and Germany are under severe restrictions around Easter. This forward-looking gauge has raised expectations for Friday's Nonfarm Payrolls report, which is set to be the first of many upbeat publications.

The economic calendar is pointing to an increase of over , positions, but some analysts have also touted one million jobs gained. On the other hand, Thursday's jobless claims statistics disappointed by jumping back above , The mix of low liquidity and high expectations could prove explosive for currencies, where trading remains active despite the holiday. Hopes for a strong global recovery have outweighed concerns about oversupply. Ethereum is flirting with the round 2, level. At that point, the Fibonacci The TCD Technical Confluences Detector is a tool to locate and point out those price levels where there is a congestion of indicators , moving averages, Fibonacci levels, Pivot Points, etc.

In doing so, the pair sellers attack an ascending support line from March Hence, a downside break of 0. On the flip side, multiple hurdles between 0. Interest dropped by around 1.

On the other hand, volume increased for the second session in a row, now by around Prices of Natural Gas edged higher on Thursday and reversed a couple of negative sessions. The recovery was amidst shrinking open interest and warns against the continuation of the uptrend, at least in the short-term horizon.

In the same line, volume went up markedly by around Asian shares remain on the front-foot even as major bourses are off due to the Good Friday holiday. Also portraying the market optimism are the stocks in China where the benchmark is up over 1. Elsewhere, South Korea follows the tune of China and Japan, also cheer upbeat inflation figures at home, while rising 0. Though, the rest of the key markets were off for an extended weekend. Traders added around 2.

Volume, instead, went down for the third session in a row, this time by nearly 41K contract. Rising open interest amidst the positive price action opens the door to the continuation of the uptrend in the very near-term. In doing so, the pair remains depressed inside a rising wedge bearish formation near the highest levels since late November.

Silver Price Analysis: XAG/USD drosp below $26.00 on rising wedge confirmation

While a clear break of 6. Meanwhile, the corrective pullback can eye 6. Over the near term, the fiscal push is positive for the USD as it anchors US growth and intensifies inflation concerns. However, President Biden may choose to fund the massive stimulus plan with either much higher taxes or more elevated supply of US Treasuries. Both choices may have unpleasant implications for the USD over the longer term. The brighter global growth outlook means that cyclical and risk currencies within the Majors and Asian FX space would regain their footing and strengthen anew against the USD.

Specifically, we had in mid-March raised our year end forecast for 10 year US Treasuries yield to 2. After announcing major relief to the Britons earlier in the week, the government is gradually easing the coronavirus COVID restrictions to help them celebrate the festivities at home. It should, however, be noted that Good Friday dominates above all and the US dollar continues to linger, despite sluggish moves, which in turn keeps buyers hopeful.

Patrones de Candelas Japonesas

Moving on, considering the high hopes from the US employment figures for March, any disappointment will have higher costs and may renew the US dollar strength. While a daily closing beyond 1. Though, pullback moves to the 1.

The sell-off in the US dollar, driven by the tumbling Treasury yields, also collaborated with the upbeat momentum in the dollar-denominated oil. Meanwhile, the number of active oil rigs in the US rose to from last week, which could have contributed to the pullback in the commodity. Although the strong support area is expected to trigger a bounce, any failures will have another bouncing point of 1.

Meanwhile, corrective pullback beyond the SMA level of 1. Following that, US Senate Majority Leader Mitch McConnell also joined the league while pushing the Biden administration to impose meaningful international consequences. Amid all these plays, the US year Treasury yields stay depressed after dropping the most in five weeks on Thursday whereas the US dollar index DXY looks for fresh clues but remains pressured.

Given the off in multiple markets, little entertainment is expected from trading ahead of the key US jobs report for March. The daily moving average DMA at 0. A firm break above the latter could expose the downward-sloping DMA at 0. However, with the relative strength index RSI still trending below the midline, the recovery is likely to remain short-lived, as the sellers could regain control. Further south, the 0. Even if Good Friday restricts the market moves, with holidays in Australia and New Zealand, the extended US dollar weakness seems to play its role in favoring the kiwi buyers.

US dollar index DXY stays on the back foot below US Depart of Statement condemned the arrests of key democratic personalities in Hong Kong while the Senate Majority Leader Mitch McConnell pushed Biden Administration to gather international support to take punitive actions against China due to the said instance.

Elsewhere, US health expert Dr. Anthony Fauci said that the US may not need the AstraZeneca vaccine even if it gets regulatory approval for usage. The news renewed vaccine jitters as the Anglo-Swedish vaccine is among the top covid cure. A daily close beyond 0. The run-up also gains support from strong momentum, favoring the bulls. Even if the Good Friday holiday restricts the moves, the latest challenges to risk, coupled with the extended weakness of the US Treasury yields, seems to keep the sellers hopeful ahead of the key US Nonfarm Payrolls NFP data.

The convictions of seven veteran Hong Kong activists, including barrister Martin Lee and media tycoon Jimmy Lai, sparked global fury against China. Elsewhere, US Dr. The same raises questions over the vaccine supply even if the health expert turned it down. Furthermore, the coronavirus COVID lockdowns in France and Canada join fears of covid strains, Brazil recently found one more variant, to weigh on the market sentiment.

Upside-Downside Gap Three Methods Technical Patterns | Myfxbook

That said, the US year Treasury yields marked the heaviest drop in five weeks the previous day and are down 0. Unless breaking the Meanwhile, an ascending trend line from January 11, , near This, together with the receding bearish bias of MACD, keeps buyers hopeful. Though, a clear upside break of 1.

Meanwhile, 1. In a case where the quote drops below 1. Additional comments from Dr. Elsewhere chatters also grew louder suggesting the US government is working on new travel guidance for vaccinated Americans and the same will be out by Friday. However, nothing key appeared strong during the dull Good Friday markets.

Given the holiday in multiple Asian markets, due to the Good Friday, there was a little reaction to the news that should have ideally weighed on the sentiment. In doing so, the cable teases a key resistance convergence comprising important SMAs and a short-term falling trend line. However, a daily closing beyond the same becomes necessary if the bulls are to challenge the 1. Late Thursday, a Hong Kong court found seven prominent democrats guilty of unauthorized assembly charges, including year-old barrister Martin Lee and media tycoon Jimmy Lai, 72, said Reuters.

Secretary of State Anthony Blinken said on Wednesday he had certified to Congress that Hong Kong did not warrant preferential economic treatment under a law that had allowed Washington to maintain a special relationship with the city, reiterating decision reached last year. The announcement sparked global fury and US Senate Majority Leader Mitch McConnell also joined the league while pushing the Biden administration to impose meaningful international consequences. Although the Good Friday holiday restricts market moves, the news should weigh on the sentiment and help the US dollar to recover some of the latest losses.

With most markets closed due to the international holiday, traders are likely waiting for markets in Japan and China to open for direction.

Análisis Técnico – USDJPY aún sin mostrar signos de rellenar el gap bajista

However, major attention will be given to the US employment figures for March. Also favoring the sentiment could be upbeat vaccine news and unlocks in the UK and Australia. However, fresh lockdowns in France and Canada join the Sino-American tussle, as well as fears of fading economic recovery to weigh on the mood. Amid these plays, US Treasury yields dropped the most in five weeks whereas Wall Street benchmarks cheered another stimulus, as well as hints for a few more, while positing over 1. However, the dearth of liquidity can trigger wild spikes and hence traders should be careful during such times.

Also, the market fears concerning covid resurgence and China versus the West can favor the US dollar, due to its safe-haven demand, which in turn may test the latest run-up. Additionally, US employment figures for March have high hopes and any disappointment should be enough during the holiday-thinned trading to recall gold sellers. To the upside, the To the downside, there is not really anything by way of meaningful support until all the way back to the US government bond yields dropped sharply on Thursday, with the year shedding about 7bps to fall under 1.

Rather than FX markets trading as a function of rate differentials, FX markets appear to have traded more as a function of risk appetite on Thursday and risk was very much on.